Hi all,

Today was a shit day for me, plain and simple, I was blinded by bias and trying to do two things at once today, this has happened twice this week and I think that this weekend I’ll take some time to review what’s been contributing to my biases.

Now, I am one of the people in the “this can’t end well” camp with the market, but each time I feel that it’s correct to impose my view, the market decides to go in the opposite direction. Take today, we’re coming up on 4000 after a 75BPS rate hike, TWO consecutive quarters of negative GDP growth, a literal recession, and before AAPL guidance (which has never thrived in a recession), we rally 90 points in one session?

Not logical.

But also, my assessment of the situation doesn’t matter, neither does yours, what matters is what the market DOES.

I have always done better and better in life by taking in more and more information, with trading, I have found it to be the exact opposite.

Levels, flows, and momentum are about all that I find truly helps me when it comes to trading (and market microstructure of course, but that’s simple at the core of it).

The more I read the news and tend to think about why various factors COULD support my thesis, the wronger I am.

I think that one of the greatest differences between Investing and Trading is exactly that, for trading, the less information the better.

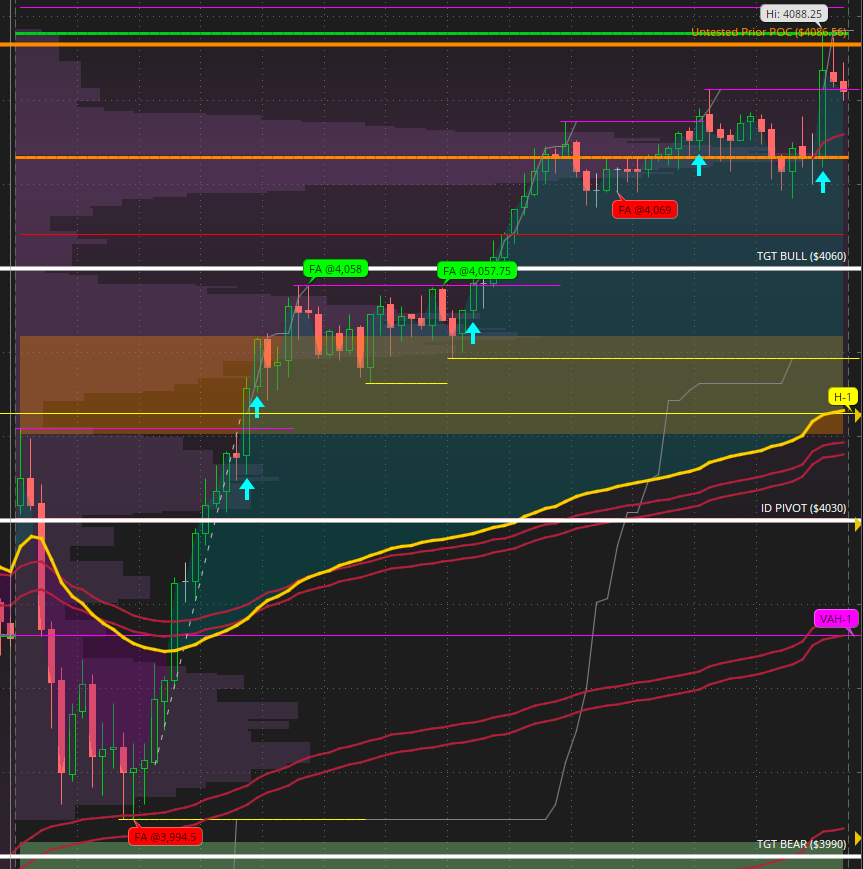

Tomorrow I will be trading light and looking for two scenarios:

If we open around 4100 I will be watching for a short run up 20-30 handles for a continuation.

If we open around 4090 or lower, I will be watching for a run down to previous OF levels.

If I don’t see either of the above, I won’t trade, and I’ll cut out of the day early around 11 to study.

Stay sharp, execute efficiently.

Warm regards,

Blueberry Jones